John Norstad, a retired mathematician, had presented three proofs that prove Total Stock Market (fund) is efficient. This is interesting so this note shares with you those three proofs.

You can read about the proofs here and join the bogleheads forum to discuss about the proofs here

I have recently switched to mostly investing in Vanguard Total Stock Market Index Fund (VTSAX) so this study gives me some assurance that this is the right approach. Of course, stock market is volatile and risky, so imo, this only plays out if there is a long time horizon for investing.

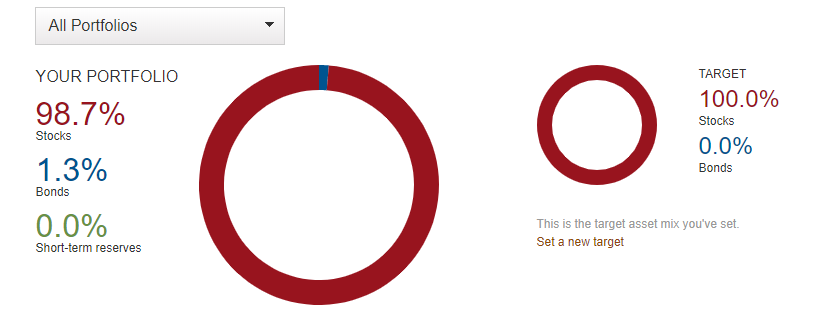

If you are wondering about the asset allocation that I am following, here is the breakdown:

- 401K: 100% Vanguard Target Retirement 2055 Fund (VFFVX)

- Roth IRA: 100% VTSAX

- Rollover IRA: 100% VTSAX

- Taxable Account: 100% VTSAX

This portfolio seems to fit nicely with the approach of lazy investing as I do not have to worry about buying individual stocks and doing the due diligence to research about individual companies. You may argue stock picking can result in better investment over time but I think simplicity is the key to investing.

Checkout some of my other finance’s notes